We just saw the biggest home price decrease for single-family homes since 2012 here in the Twin Cities. So what does that mean for people looking to buy or sell a house? Read more to find out!

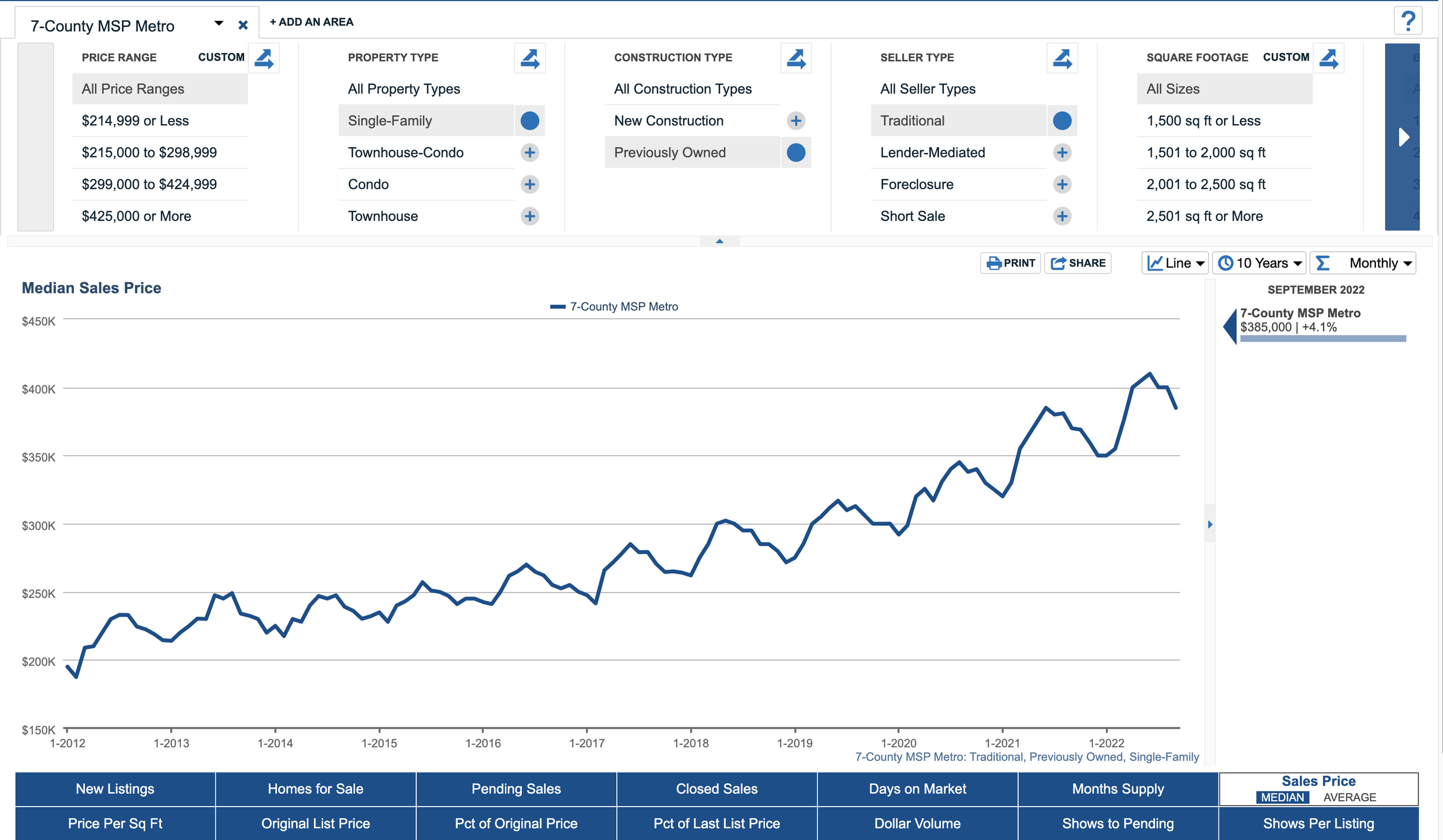

When we look at this data, we are looking at the seven-county metro and single-family homes. We like to focus on previously owned, traditional sellers since that is the most common sale type. The average sales price for these homes was $400,000 in August, down to $385,000 in September. That’s a $15,000 price drop in single-family homes here in just a month. That's the biggest drop we have seen since August/September in 2010 when they dropped from $257,000 to $234,000. But, if you take a look at the chart below, you can actually see that this is something that happens every year.

Image provided by Infosparks and NorthstarMLS

As you can see here, the market fluctuates each year. We see a slow down over the winter and in the spring things start to heat up again. But this is the single biggest drop we have seen in 12 years in the Twin Cities so it’s something to pay attention to. If we look at the month’s supply of homes, we’ve stayed consistent at 1.4 months. What that means is if no more houses came on the market we would run out of homes for sale in 1.4 months.

Another thing to be aware of is leading and lagging indicators. If a leading indicator informs business leaders of how to produce desired results, a lagging indicator measures current production and performance. While a leading indicator is dynamic but difficult to measure, a lagging indicator is easy to measure but hard to change. Home sale prices are, without a doubt, a massive lagging indicator. That’s because when we are looking at the September numbers, these are properties that were put under contract a minimum of 30 days before September, and up to possibly 60, to 70 to 80 days before September. So, we’re really looking at homes that went under contract in July. So what does that mean? It means that it’s likely in April that we saw the peak of our market here in the Twin Cities.

Now, a lot of people are wondering, what is going on? How is this affecting our market? Is this a good time to buy? Is this a good time to sell? Mortgage rates are through the roof. They've come down in the past week about a half of a point, but they’re still much higher than they have been over the past few years.

Once we hit spring, we'll likely see home value appreciation pick back up, but not as crazy as it was during the pandemic. What went on is pretty unheard of and will likely never happen again. We’ll also probably never see 3% interest rates again, which is what helped drive the market into an absolute frenzy. Our prediction is that we’re likely going to see things leveling out long-term. Our growth will likely slow for a while but we will be back to 3% to 5% typical growth in the future.

With all of the craziness going on, how is the Twin Cities market staying strong? We’re different than a lot of the country that has seen huge increases and crashes afterward. We have enough demand in our market that even with home prices starting to decline, which they do every year, our housing market should remain strong. New construction has also slowed down which is helping to keep our inventory low.

One of the biggest things keeping inventory low is the interest rates. Right now, it’s easier for people to hang on to their house with their 4% interest rate, renovate it to meet their needs, and continue living there rather than move somewhere else for nearly twice the interest rate. The average number of years that people stayed in one house used to be around 8 years but recently it has increased to 13. As people stay in their homes longer, inventory stays slightly stagnant. Interest rates would have to fall in order to incentivize a lot of homeowners to leave their current mortgage.

But we all hear it, the market's gonna crash. There are foreclosures coming. Except when you look back at the data, you can see where we’re really at. According to Attom, one of the best sources for real estate information, this is the first half US foreclosure activity by year:

Graph provided by Attom

2021 was a very low year for foreclosures, but if you look, we're just getting back to 2020 levels, and we're more than a hundred thousand below where we were in 2019. You can see we’re pretty far behind where we have been in years past.

So why don’t we have a lot of foreclosures right now? It’s because people are equity rich in the United States. Almost half of the mortgaged homes in the US are now considered equity rich. Homeownership has reached a milestone in the US. Nearly half of mortgage properties are considered equity rich in the second quarter, meaning owners had at least 50% in home equity. This marked the ninth straight quarterly rise, fueled by soaring house valuations during the pandemic. That means we are stable with where we're at right now. Although the housing market has cooled recently, the percentage of equity-rich properties will probably keep increasing according to Attom. So they also believe that we are going to see home prices go up and when home prices go up, that means rent goes up.

You see, we're in a very, very interesting market. The rental prices have gone through the roof over the past couple years, and as housing becomes more unaffordable for the everyday American, more people are choosing to rent. Well, when more people are choosing to rent, what does that do to the house? The rental market? It causes rent prices to continue to go up. Interest on rentals is 100%. You can either pay your mortgage or pay somebody else's. It's up to you. But as house prices go up, rent will always go up.

According to CNBC, rent prices will continue to go up in 2023:

“Median rent in the nation's 50 largest cities fell by $10 a month, the first drop since November. But a one-month decline is not necessarily the start of a long-term trend. In fact, rent price growth will likely remain elevated well into 2023. Rent growth could slow, but we may not see it go back to what it was typically before. The pandemic rental demand will remain strong due the housing due to rising home ownership costs, especially with mortgage expense, nearly doubling since January. This has forced many would be home buyers to stay in the rental market, exasperating the already high demand.”

So what does this mean for you in this current market? Well, it really depends on your situation. The best time to make a move is when it makes sense for you, when you decide that the time is right for you.

When that noisy neighbor is too much, you can’t listen to the barking dog anymore, you've outgrown the house because your kids are growing up and you need more space for them, or your kids have moved on and you're downsizing. The time to make a move is when it's best for you. Yes, interest rates are high right now but it’s also the first time in two years you can negotiate the sellers paying your closing costs or possibly get the home for a little under value.

Rates are high right now and we understand that. But there are things you can do! One thing is called a 2-1 buy-down. This is paid by the sellers and it allows a buyer to have a 2% less interest rate. The first year and second year of their mortgage they have a 1% less interest rate than whatever they locked in at. The third year goes back to the rate they locked in at. If this is something you’d like to learn more about, please reach out!

We’re also coming up on an election year here, and history does show us that during election years, interest rates come down, making it a perfect time to refinance. But remember, if interest rates come down, all the homebuyers that have been sitting on the sidelines waiting will be back in the market and it could turn into what we saw for the past two years.